I was more surprised than I should have been to learn recently that Mint will be shutting down at the end of this year. Mint is a free online personal finance tool that I've been using for well over a decade: it consolidates all of your linked accounts (banks, credit cards, loans, and investments), giving you a great holistic view of your finances. At the granular level you can see every transaction you've made (so credit card and debit card purchases appear in the same view); you can also zoom out and see how your savings have changed over time, what you've been spending most of your money on, and so on.

Mint is one of those services that I've felt a lot of irritation at over the years, and yet now that it's going away I feel a lot of disappointment. It had obviously been under-invested in for years and years after Intel acquired it, most obviously in continuing to use Macromedia Flash up until the very last possible minute that Apple and the web browsers eliminated it. A lot of little things irked me, like transfers between accounts showing up as "expenses" that dwarfed my actual expenditures; but still, it's been a really helpful tool for me to keep on top of my personal financial picture for a good chunk of my life.

I've never been good at budgeting. I think I'm good at spending - I'm a natural saver, and have consistently lived below my means, and don't feel much regret about hings I've bought. But never in my life have I sat down and actually made a plan about what I'm going to spend money on in a given month. That seems so dull!

That's another way where Mint has been really helpful for me. Where old-fashioned pen-and-paper budgeting and most modern software programs require forward planning, Mint supported a more passive form of reactive budgeting: it tracks how much you've spent on, say, groceries or restaurants over a series of months, and calculates the average you've been spending. It then presents that for the current month, along with your costs to date. This gives a good way to see trends and notice when you're skewing higher or lower, without requiring any up-front work.

As with a lot of Mint stuff, I tended to focus more on the annoyances. For example, there's a "Gas" category. Since I mostly take transit and rarely drive, I would only need to fill up once every 3 months or so. Mind happily assigned an "average" expense of, like $15 on gas a month, but my actual spend would either be $0 or $45 depending on whether I filled up that month or not, so it wasn't very useful. Still, in retrospect what it was doing was pretty cool.

The most value I got out of Mint was probably as a short-cut to filling out a separate spreadsheet I maintain. Basically, whenever I'm moving money from a short-term spending account into long-term investments, I want to look at my overall asset allocation between my 401k, my Roth and my taxable account, and direct the incoming money into the appropriate asset class. For example, I'm currently aiming for around 28% of my assets to be in an International Stock fund, so if I'm currently at just 26%, I'll direct most or all of the incoming money into that fund. With Mint, I can just lot into one service, look up the balances for all my accounts and funds, plug those into the right cells on my spreadsheet, and figure out what to do.

I imagine a lot of other people are in the same boat as me: people use Mint for different reasons, but no matter what that reason is, they'll need a new option. In the past I've occasionally searched for alternatives to Mint, and found that there aren't any other good free services that exactly replace it. Since it's going away entirely, I decided to take another look.

There are apparently a lot of banks and brokerages that now offer free Mint-like services, where you can link other accounts to the bank, and view all your balances, transactions and history in a single place. Unfortunately, neither my credit union nor Vanguard are among those offering it.

Intuit is hoping to move the Mint users to Credit Karma, another service it runs. Credit Karma doesn't come anywhere close to replicating Mint's features, though: it mostly shows you your credit score and steers you towards sponsored products.

From some reading around Reddit, Bogleheads and other sites, it sounds like YNAB (You Need A Budget) is the most popular alternative. I've been reading about YNAB for years, and it has a lot of enthusiastic adherents. After some more investigation, though, I don't think YNAB is a good match for me in particular. For better or worse, it's heavily budget-based, and is built around the kind of prescriptive forward planning that I dread. I'd need to change my whole approach to personal finance, and man, I just don't want to make that effort!

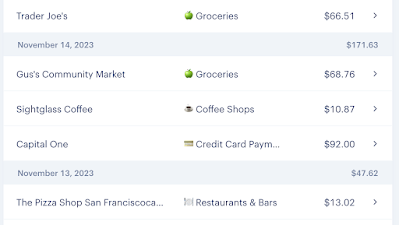

I'm currently trying out Monarch Money, which was started by one of the original founders of Mint and seems to share some of its DNA. Like all of these alternative services, it does cost money; I'm on a 30-day trial at the moment, and they're offering a coupon code for half off the first year: ordinarily it's $100 a year, but the first year will be $50. That feels like a lot compared to the $0/year I've been spending for over a decade, and I'm still trying to make up my mind whether that's worth it or not. Mint was my go-to for a financial overview, but I probably only opened it a couple of times a month. Looking at the data is interesting, and it would save me some time over logging into like four accounts individually. Is that worth eight dollars a month? I don't know.

I can tell that Monarch Money is relatively new, for better and worse. The UI is much better than Mint's: well-designed and intuitive, with nice colors and organization. The default categories are much more 2020s than 2000s; Mint has a category for DVDs! One of the more glaring things I've noticed so far with Monarch is with its charts; after importing 10+ years of data from Mint and viewing my account histories, I noticed that the labels for, like "June 9" and "December 13" were only giving dates and omitting years. If I'm looking at 13 years of history, I want to see those years in the labels!

One thing that is cool about Monarch is that they are very transparent about what they're doing, unlike the absolute silence from Mint for the last decade-plus. Monarch has a really cool public tracker where you can see what feature requests users have made, can vote on the one(s) you want to see, and see what items are in progress and recently completed. Their CEO and their engineers are fairly active on their blog and Reddit, not just writing about what they're working on but the reasons behind decisions they're making. Among other things, they have given a frank explanation of the reasons why they charge: as the old adage has it, if you're not paying for a product, then that means that you are the product.

Monarch does have a Budget (/Plan) option, which I haven't really checked out yet, but from what I've read it's more similar to the reactive Mint approach, so I'm hoping that it works for me: more of an occasional temperature check of how I'm doing than a detailed roadmap of what I should do.

So anyways, it's been an interesting experiment so far. Part of me kind of wants to massively build out my existing spreadsheet to add transaction-tracking and categorization, but while that would be fun to set up, I doubt I'd have the patience to keep it up-to-date. It's possible that some new free alternative will come around, or maybe Vanguard or my credit union will start integrating the core features for me... or maybe I'll just get used to spending eight bucks a month on this. That's a lot less than Netflix costs nowadays, I guess.

I actually used to use Mint as well but stopped after Intuit acquired them due to concerns about how my data would be used. My approach to budgeting and tracking spending is pretty similar to yours, so thanks for discussing the alternatives! I might have to give Monarch a try.

ReplyDeleteOh, you're wiser than I am to have stopped using them! I'm a sucker for convenience.

DeleteI'm finding more gaps in Monarch's offerings as I use the product more. They don't seem to have any pie charts, just line and bar graphs. They do consolidate investment holdings from multiple sources, which is nice, but it's hard to pull out the big-picture analysis that Mint made very easy. That said, I can tell that they're actively developing it, so I'm hoping that by 2024 it will be closer in parity to what Mint had.

I think my current recommendation is for people to hold off on their free trial of Monarch for a while longer. In its current state it's hard to enthusiastically recommend at $50/$99, but I can see them getting to that point in the future.